Appeals Rights Regarding Medicare Set-Asides (MSAs)

There is no formal process to appeal the Center for Medicare & Medicaid Services (CMS’s) determination regarding a submitted Medicare Set-Aside (MSA) proposal. However, there are several other options available.

Re-Review Medicare Set-Aside

A request for re-review may seek to have CMS issue a new determination based on a mathematical error in calculating the cost of future treatment in the MSA determination or because treatment was mistakenly included in the future projection that has already occurred. A re-review is also appropriate when there is additional evidence (not already considered by CMS) that warrants a change in CMS’s determination. CMS will permit a one-time re-review in the form of a new submission.

Amended Review for Medicare Set-Aside

Amended Review is intended for situations where the Injured Worker’s condition improves to an extent that the previous MSA amount is greater than the expected future treatment. The following criteria must be met to submit a MSA for amended review:

- CMS has issued a conditional approval at least 12 months but not more than 72 months prior;

- The case has not yet been settled, as of the date of re-review; and

- Projected care has changed sufficiently to justify a 10% or $10,000.00 change (whichever is higher) in treatment.

Because an amended review may only be filed once, it is important to gather all evidence and wait for any expected improvements before filing. It is also important to monitor the deadline to file within 6 years from the original MSA determination.

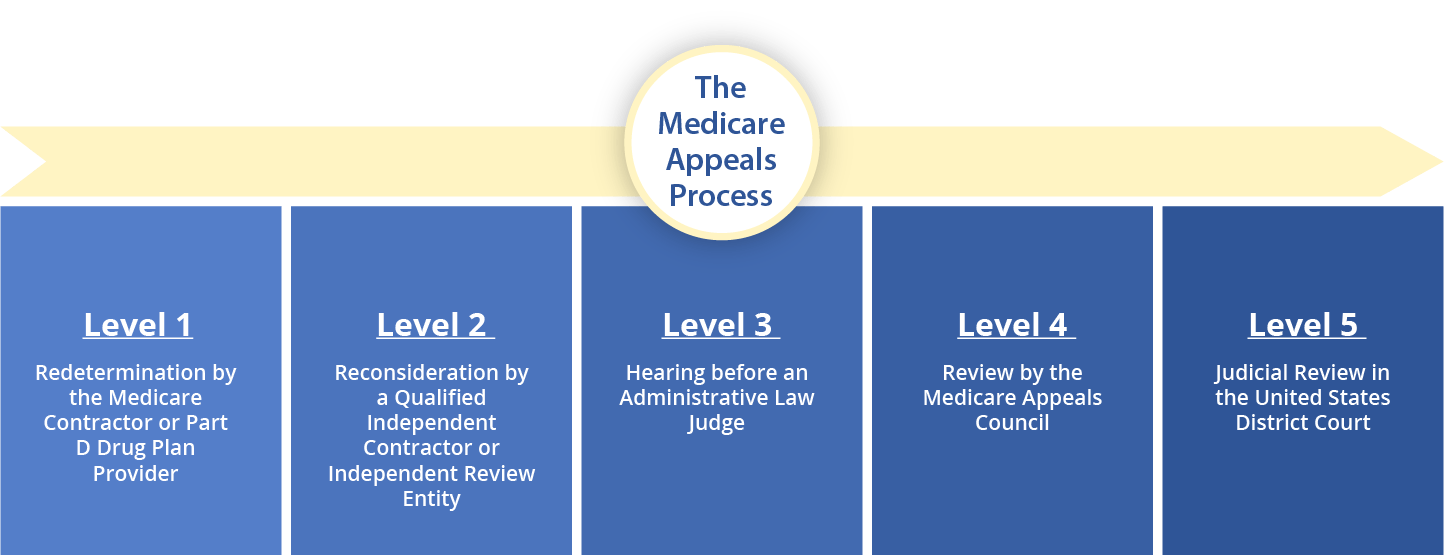

The Medicare Administrative Appeals Process for Denied Bills

While CMS’s determination regarding the amount of the MSA may not be appealed, Medicare’s denials of individual bills may be appealed. The Social Security Act establishes a review for medical treatment or prescription bills denied by Medicare. Some of the levels may be familiar as they are also used in Social Security Disability (SSD) cases. The process can be very lengthy and onerous. The five levels of review are redetermination, reconsideration, Administrative Law Judge Hearing, Medicare Appeals Council Review, and review in Federal District Court.

Level 1: is the first stage of an appeal after Medicare denies payment of a bill and it is called the reconsideration stage. The appeal is processed on the written record only.

- For Part A & B Plans: a reconsideration must be filed within 120 days of the date of the denial. The appeal is assigned to the original Medicare Contractor who is supposed to issue a decision within 60 days.

- For Part C Plans: a reconsideration must be filed within 60 days of the date of the denial. The appeal is assigned to the original Medicare Contractor who is supposed to issue a decision within 30 days for requests for pre-service or within 60 days for requests for payments. The level 1 appeal is escalated to level 2 if the required deadline is not met.

- For Part D Plans: a reconsideration must be filed within 60 days of the date of the denial. The appeal is assigned to the original Prescription Drug Plan Provider who is supposed to issue a decision within 7 days for benefits and 14 days for payment. There is an expedited 72-hour process if it can be shown that the beneficiary’s health will be seriously jeopardized by waiting for a standard decision.

Level 2: is the redetermination stage and is also processed solely on the written record.

- For Part A & B Plans: a redetermination must be filed within 180 days of receiving the written determination of the Level 1 appeal. The review is completed by a Qualified Independent Contractor (QIC) retained by CMS. QICs have their own doctors who will independently review the denial. The QIC should issue a decision within 60 days or the case may be escalated to Level 3.

- For Part C: a redetermination must be filed within 60 days of receiving the written determination of the Level 1 appeal. The review is completed by an Independent Review Entity (IRE) retained by CMS. IREs have their own doctors who will independently review the denial. The IRE should issue a decision within 30 days for pre-services and within 60 days for services or the case may be escalated to Level 3.

- For Part D: a redetermination must be filed within 60 days of receiving the written determination of the Level 1 appeal. The review is completed by an Independent Review Entity (IRE) retained by CMS. IREs have their own doctors who will independently review the denial. The IRE should issue a decision within 7 days for benefits and 14 days for payment. There is an expedited 72-hour process if it can be shown that the beneficiary’s health will be seriously jeopardized by waiting for a standard decision.

Level 3: An appeal must be filed within 60 days of the reconsideration and go before the Office of Medicare Hearings and Appeals (OMHA). The case proceeds to a hearing before an Administrative Law Judge (ALJ) who makes a de novo decision. The ALJ may also ask the beneficiary to consent to a favorable decision on the record. The OMHA is supposed to issue a decision within 90 days. However, due to a large backlog of cases, this time frame is unlikely to be met and can actually take a year or more. There is also a requirement that the amount in controversy is greater than $180.00.

Level 4: An appeal from the OMHA decision must be filed with the Medicare Appeals Council (Council) within 60 days of receipt of the unfavorable decision. Please note that the receipt of the unfavorable decision is assumed to be 5 days after the date listed on the decision. The review is on the written record only. The Council should process the appeal in 90 days. However, a large backlog of cases typically causes the review to take much longer.

Level 5: An appeal from the Council must be filed by initiating a civil action in Federal District Court within 60 days of receipt of the unfavorable decision. Please note that the receipt of the unfavorable decision is assumed to be 5 days after the date listed on the decision. In addition, the amount in controversy must be at least $1,760.00. The Court may decide on the record or schedule an oral argument. This is the final level of an appeal.

To avoid the lengthy and uncertain Medicare Appeals Process, it is important to make sure your MSA is properly allocated, funded, and administered. MSA Meds is here to guide you at every stage of the process. Contact us to discuss how we can help you!